According to the latest data from the

National Association of Realtors, the median existing-homes sales price rose to $236,400, which exceeds the previous peak median sales price set in July 2006 of $230,400.

June’s total also rose 6.5% above June 2014.

In May, the median existing-home price for all housing types

was $228,700, which was 7.9% above May 2014.

That marked the 39th consecutive month of year-over-year price gains, making June the 40th straight month of year-over-year price gains.

Despite record prices, existing-home sales also reached their highest pace in more than eight years.

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, increased 3.2% to a seasonally adjusted annual rate of 5.49 million in June from a downwardly revised 5.32 million in May.

Sales are now at their highest pace since February 2007 (5.79 million), have increased year-over-year for nine consecutive months and are 9.6% above a year ago (5.01 million).

Lawrence Yun, NAR chief economist, said that buoyed by June's solid gain in closings, this year's spring buying season has been the strongest since the crisis began.

"Buyers have come back in force, leading to the strongest past two months in sales since early 2007," Yun said. "This wave of demand is being fueled by a year-plus of steady job growth and an improving economy that's giving more households the financial wherewithal and incentive to buy."

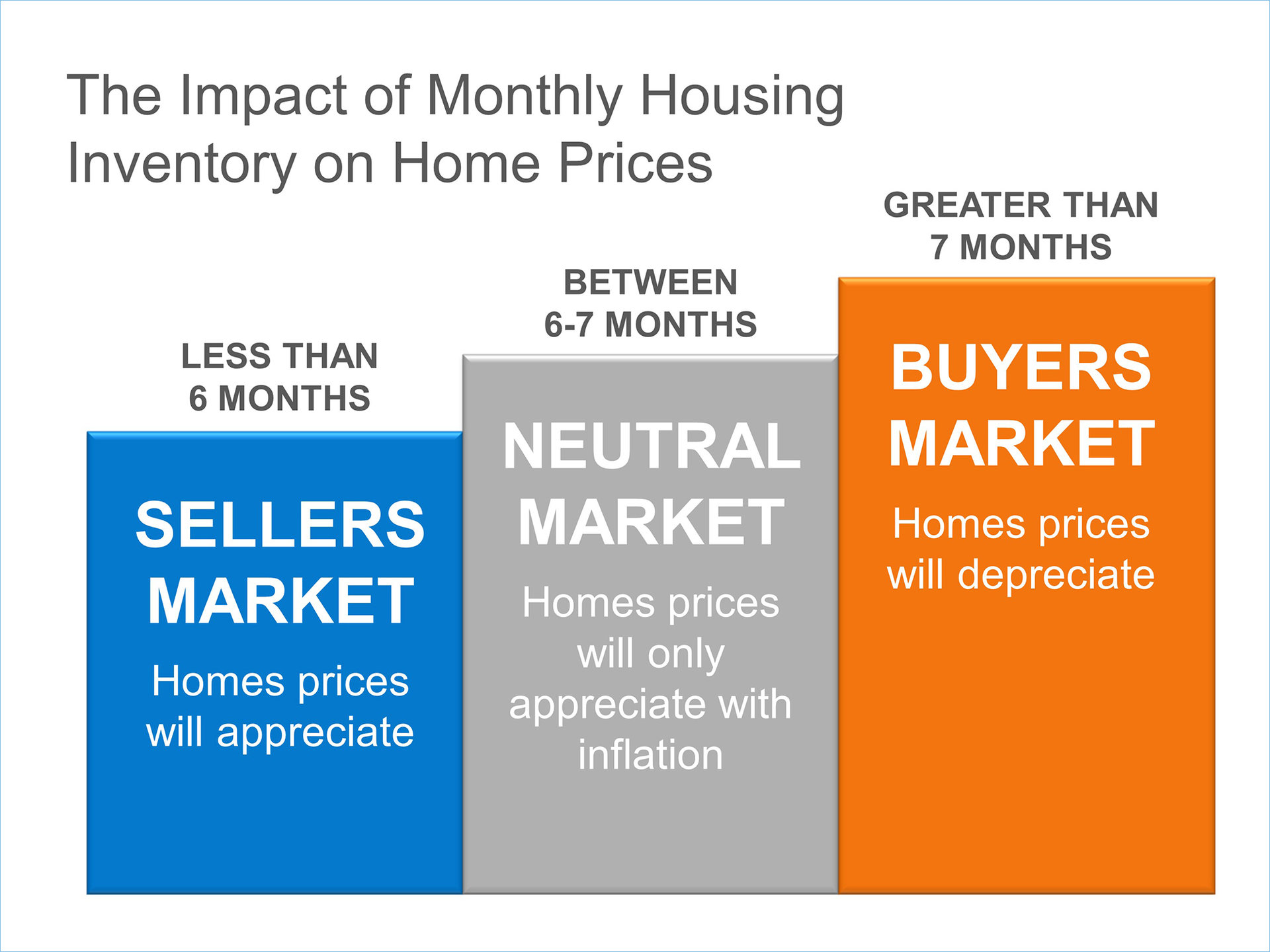

According to NAR’s report, total housing inventory at the end of June rose slightly by 0.9% to 2.30 million existing homes available for sale, which is is 0.4% higher than the same time period a year ago (2.29 million).

Unsold inventory is at a 5.0-month supply at the current sales pace, down from 5.1 months in May.

"Limited inventory amidst strong demand continues to push home prices higher, leading to declining affordability for prospective buyers," said Yun. "Local officials in recent years have rightly authorized permits for new apartment construction, but more needs to be done for condominiums and single-family homes."

According to NAR’s report, the percent share of first-time buyers fell to 30% in June from 32% in May, but remained at or above 30% for the fourth consecutive month.

One year ago, first-time buyers represented 28% of all buyers.

NAR President Chris Polychron said that Realtors are reporting “drastic imbalances” of supply in relation to demand in many metro areas — especially in the West.

"The demand for buying has really heated up this summer, leading to multiple bidders and homes selling at or above asking price," Polychron said. "Furthermore, tight inventory conditions are being exacerbated by the fact that some homeowners are hesitant to sell because they're not optimistic they'll have adequate time to find an affordable property to move into."

All-cash sales dropped to the lowest share since December 2009, reaching just 22% of transactions in June, down from 24% in May and 32% a year ago.

Individual investors, who account for many cash sales, purchased 12% of homes in June (14% in May) — the lowest since August 2014 (also 12%) and down from 16% in June 2014.

Distressed sales, which are foreclosures and short sales, fell to 8% in June (matching an August 2014 low) from 10% in May, and are below the 11% share a year ago.

According to NAR’s data, 6% of June sales were foreclosures and 2% were short sales. Foreclosures sold for an average discount of 15% below market value in June (unchanged from May), while short sales were discounted 18% (16% in May).

NAR’s report also showed that single-family home sales increased 2.8% to a seasonally adjusted annual rate of 4.84 million in June from 4.71 million in May, and are now 9.8% above the 4.41 million pace a year ago.

The median existing single-family home price was $237,700 in June, up 6.6% from June 2014 and also surpassing the peak median sales price set in July 2006 ($230,900).

Existing condominium and co-op sales rose 6.6% to a seasonally adjusted annual rate of 650,000 units in June from 610,000 units in May, up 8.3% from June 2014 (600,000 units) and the highest pace since May 2007 (680,000 units).

The median existing condo price was $226,500 in June, which is 5.5% above a year ago and the highest since August 2007 ($229,200).

"June sales were also likely propelled by the spring's initial phase of rising mortgage rates, which usually prods some prospective buyers to buy now rather than wait until later when borrowing costs could be higher," Yun concluded.

Jonathan Smoke, the chief economist for

Realtor.com, said that June’s data shows that 2015 is turning into the best housing market since 2006.

“This is the biggest and healthiest year for existing home sales since 2006 when speculation was rampant,” Smoke said.

“The increase in sales we’re seeing is consistent with the strong and growing demand we’ve been monitoring all year and we anticipate sales will increase as the summer progresses particularly with our expectations of growing millennial participation in the housing market,” Smoke added.

“While the market remains tight and favors sellers, the higher prices should encourage more would-be sellers and more new construction in the months ahead, lending further momentum to the market’s positive trend,” Smoke concluded.

In a note responding to the NAR report,

Capital Economics said that the rise in existing-home sales to their highest level since before the financial crisis provides further evidence that the housing recovery has shifted into a higher gear.

“The market has clearly taken the recent upturn in mortgage interest rates in its stride and demand is strengthening markedly,” Capital Economics said.

“That said, relative to the population, existing sales are now above their long-run average, and we suspect they won’t rise too much further from here,” the Capital Economics report continued. “However, the improving labor market, high levels of consumer confidence and a gradual loosening in credit conditions should ensure that sales continue at a high level in the months ahead.”