Pending Home Sales Reach Highest Mark In 9 Years!

The National Association of Realtors (NAR) recently released their Pending Home Sales Index Report and revealed that it is at its highest level since April 2006.

The Pending Home Sales Index is “a forward-looking indicator based on contract signings”. The higher the Pending Home Sales Index number, the more contracts have been signed by buyers that will soon translate to sales.Every region of the country has experienced year-over-year gains in pending sales as seen below:

NAR’s Chief Economist, Lawrence Yun cites job creation as a major reason that the housing market has boomed this spring, going on to say,

"It's very encouraging to now see a broad based recovery with all four major regions showing solid gains from a year ago and new home sales also coming alive."Yun went on to caution that,

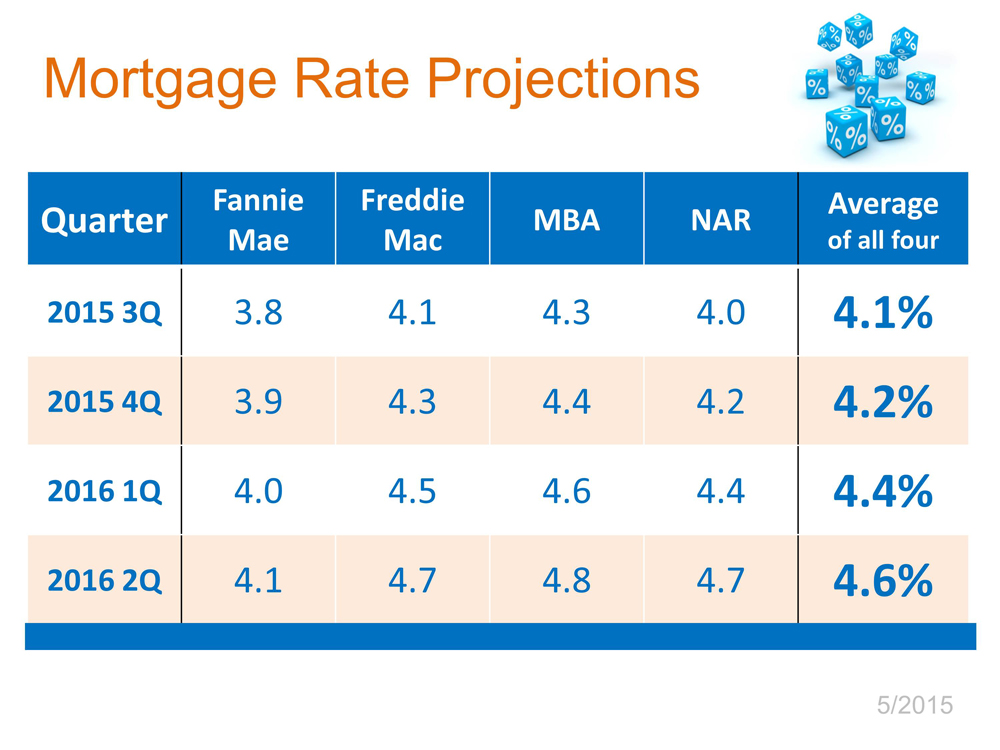

"Housing affordability remains a pressing issue with home-price growth increasing around four times the pace of wages. Without meaningful gains in new and existing supply, there's no question the goalpost will move further away for many renters wanting to become homeowners."

So What Does This Mean To Buyers?

There is a lot of competition out there right now for your dream home. Prices are going to continue to climb, act now before you are priced out of your future home.What Does This Mean to Sellers?

If you are on the fence about listing your home for sale right now and debating whether now is the time to move on with your plans of relocating… now is the time!There are more buyers that are ready, willing and able to buy their first, second, third, vacation, or investment property now than there has been in years! The supply of homes for sale is not keeping up with the demand of these buyers.

Listing your home for sale now will give you the most exposure to buyers and the best sales price.